Pakistan’s digital economy is experiencing a significant shift — from cash dominance to digital payments. The State Bank’s initiatives like Raast, the rise of fintech startups, and the growing e-commerce sector are collectively transforming how Pakistanis send and receive money online.

In 2025, businesses — from small stores to SaaS startups — are actively searching for reliable, secure, and cost-effective payment gateways to manage online transactions smoothly.

Pakistan’s Digital Payment Landscape 2025

Pakistan’s fintech sector has seen tremendous progress in the last few years. According to industry experts, digital transactions in Pakistan crossed Rs. 10 trillion annually, marking a significant jump in consumer trust and accessibility.

However, many challenges persist:

- Limited international gateway availability (Stripe & PayPal still not officially in Pakistan)

- High card failure rates due to outdated banking APIs

- Limited global currency support

- Lack of proper merchant onboarding for small sellers

To tackle this, both banks and fintech startups have introduced modern digital payment solutions catering to every segment — from freelancers to large enterprises.

What Makes a Good Payment Gateway?

A payment gateway isn’t just a transaction processor — it’s the backbone of digital commerce. Here’s what defines a strong one:

| Feature | Description |

|---|---|

| High Success Rate | Ensures fewer payment failures and smoother checkout experiences |

| Multi-Currency Support | Essential for exporters, freelancers, and SaaS companies |

| Developer APIs & SDKs | Allow seamless integration for websites and apps |

| Security & Compliance | PCI-DSS, tokenization, and 3D Secure protection |

| Affordable MDR (Merchant Discount Rate) | Low transaction cost improves profit margins |

| Quick Settlements | Faster fund transfers for cash flow stability |

| Strong Customer Support | Localized support for issue resolution |

Bank-Led Payment Gateways in Pakistan

1. Bank Alfalah Payment Gateway (MPGS / Alfalah Gateway)

Bank Alfalah is among the most progressive banks offering payment gateway solutions in Pakistan.

It supports:

- Visa, Mastercard, and UnionPay cards

- Tokenized payments for returning users

- Fraud prevention and transaction monitoring

- Integration with major e-commerce platforms (Shopify, WooCommerce, Laravel)

Pros: Strong compliance, solid reputation, smooth integration via XPay partnership

Cons: Merchant approval process may take time

2. HBL Payment Gateway

Habib Bank Limited’s gateway is widely used by established enterprises and large e-commerce brands.

Features include:

- Multiple card acceptance

- Real-time reporting dashboard

- Fraud protection layers

Pros: Reliable and bank-backed trust

Cons: Lengthy onboarding, less developer flexibility

3. UBL Payment Gateway

United Bank Limited’s solution supports both local and international transactions. It also offers Shariah-compliant options for Islamic businesses.

Pros: Local support, secure system

Cons: Limited API customization and international coverage

4. Other Bank Options (Meezan, MCB, Allied)

While many banks now offer online gateways, they’re often less flexible compared to fintech alternatives. Setup fees and integration complexity are higher, but they remain trustworthy for medium-to-large businesses.

Fintech & Hybrid Payment Gateways

Modern fintechs are driving digital transformation by offering API-first, fast, and developer-friendly payment systems.

1. XPay

A collaboration between Bank Alfalah and XStak, XPay acts as a Stripe alternative for Pakistan.

- Offers embedded checkout (customers pay directly on your site)

- Supports subscriptions, BIN discounts, and recurring billing

- Real-time payment links and analytics

Pros: Best for SaaS, marketplaces, and online stores

Cons: Newer player compared to traditional banks

2. Safepay

A Pakistan-based payment startup designed for small and medium businesses.

- Accepts credit/debit cards and local wallets

- Provides plugins for WooCommerce, Magento, and Shopify

- Transparent pricing model

Pros: Simple setup and fast integration

Cons: Limited global transaction coverage

3. PayPro

Popular among freelancers and app developers.

- API and mobile SDKs for smooth integration

- Real-time invoices and recurring payment options

Pros: Developer-focused, fast settlements

Cons: May require manual verification for new accounts

4. PayFast (GoPayFast)

Licensed under the State Bank’s PSO/PSP framework.

- Provides a compliant payment infrastructure

- Supports both local cards and mobile wallets

- Easy merchant onboarding

Pros: Secure, regulated, and local

Cons: Limited advanced customization features

5. Paykassma

An emerging platform offering high success rates and support for 100+ local payment methods (wallets, transfers, etc.).

Pros: Excellent coverage across Pakistan

Cons: Still building long-term market trust

6. Swich

A new fintech aiming to bring next-generation payment technology.

- Data-driven routing and risk management

- Modern APIs for startups and SMEs

Pros: Tech-friendly, innovative

Cons: Still early-stage in adoption

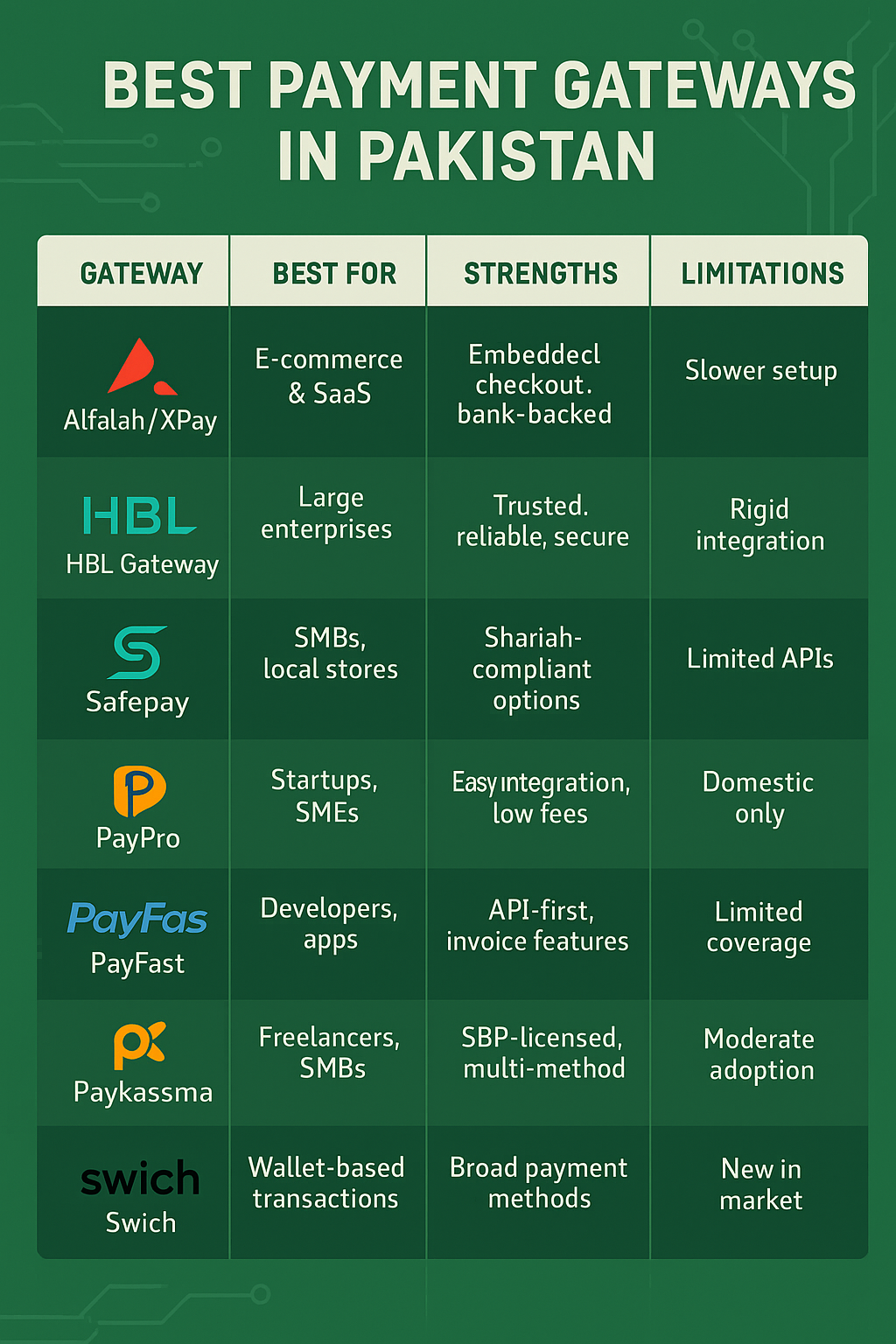

Payment Gateway Comparison (2025)

International Payment Options for Pakistan

While most local gateways cater to domestic transactions, businesses dealing with international clients often need global support.

Common international solutions:

- Payoneer: Best for freelancers and export-based businesses

- 2Checkout / Verifone: Accepts payments in USD, EUR, and GBP

- Wise (formerly TransferWise): Used for global B2B transfers

- Stripe (Indirect setups): Still unavailable officially in Pakistan

Tip: Use a hybrid model — local gateways for Pakistani customers, and global ones for international clients.

Challenges in Pakistan’s Payment Ecosystem

- Regulatory Limitations — Strict SBP guidelines for PSO/PSP operators.

- Card Decline Rates — Older banking infrastructure causes failed payments.

- Onboarding Hurdles — Complex KYC processes delay merchant setup.

- Limited Cross-Border Transactions — Many gateways still restricted to PKR.

- Consumer Trust Gap — Cash-on-delivery culture persists.

- Fraud & Scam Risks — Growing cybercrime requires better merchant education.

Tips for Businesses

- Start Locally — Begin with a domestic gateway for smoother integration.

- Combine Options — Use two gateways to maximize payment success rates.

- Monitor Performance — Track transaction failures and negotiate MDR.

- Enable 3D Secure — Adds an extra protection layer against fraud.

- Offer Multiple Payment Options — Cards, wallets, and bank transfers.

- Ensure PCI-DSS Compliance — Secure customer data and build trust.

Future of Digital Payments in Pakistan (2025–2027)

- Embedded Checkout Growth: Seamless, on-site payment experiences.

- Unified Wallet Ecosystem: JazzCash and Easypaisa integrating with major gateways.

- API-first Fintech Solutions: Modular, scalable payment systems.

- QR-based Payments: Expected surge in physical-to-digital retail integration.

- AI-driven Fraud Detection: Predictive monitoring to reduce chargebacks.

- Cross-Border Expansion: More support for USD and regional currencies.

The best payment gateway for your business depends on your transaction type, scale, and audience.

- For local businesses, Bank Alfalah (XPay), Safepay, and PayFast offer solid reliability.

- For developers or SaaS companies, PayPro and Swich bring flexibility and modern APIs.

- For cross-border or freelance payments, Payoneer or 2Checkout remain reliable companions.

As Pakistan’s digital economy grows, integrating a secure, transparent, and efficient payment system will no longer be optional — it will define business success in the digital era.